Insurance and Takaful are essential for financial planning. You pay a premium the company absorbs your financial risk.

Islamic Insurance Islamic Finance Resource

In takaful the risk is reduced within a social group as a collaborative insurance measure.

. A determined sum is contributed to a shared pool of. Takaful is open to everyone and one does not have to be Muslim to take on Takaful coverage or to be a Takaful agent. Lack of awareness may be the reason behind why people think Takaful is only meant for Muslims when in fact Takaful is broad and.

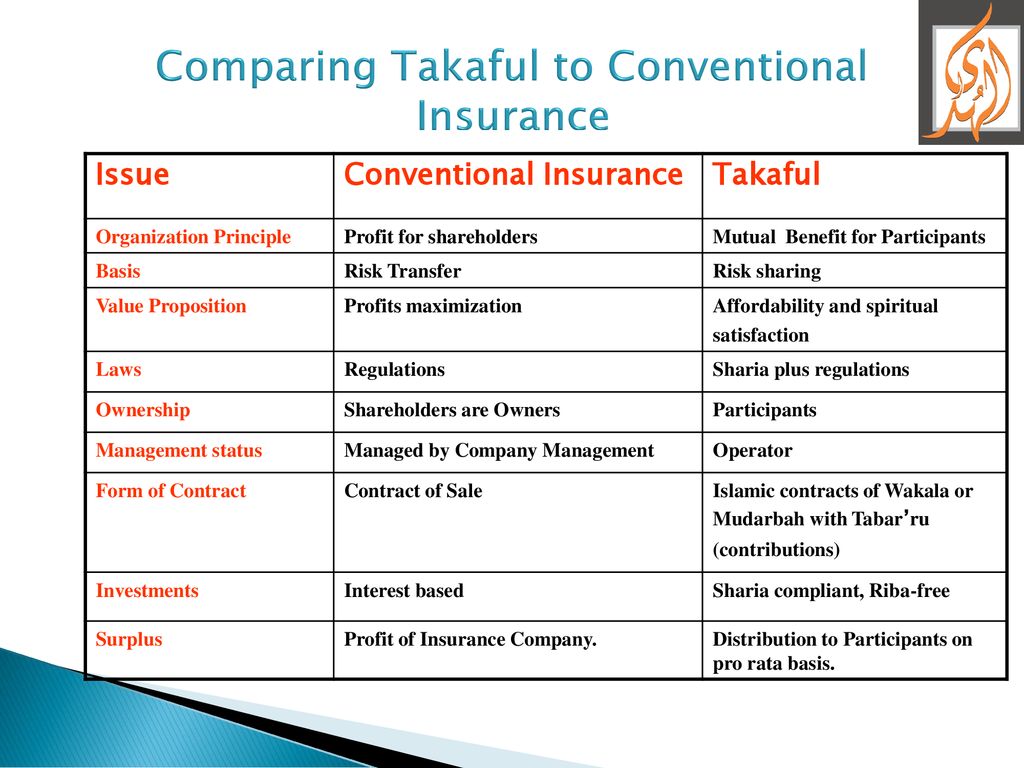

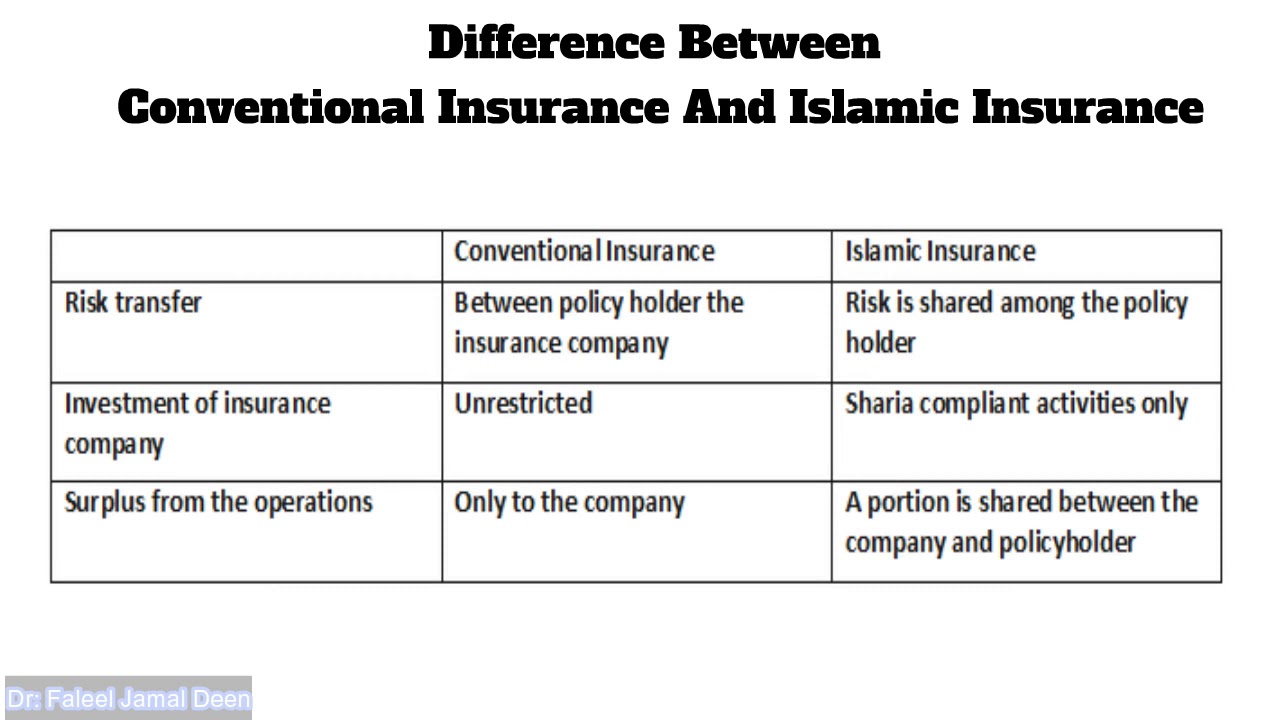

Takaful-The insurance company has to. Furthermore unlike conventional insurance the participants in Takaful retain an. In conventional insurance the risk is transferred from the insured to the insurer.

Get a Free Auto Insurance Quote Online Today with State Farm and Get Covered. Other differences are the relationship between the operators and the participants. INTRODUCTION A broad spectrum of conventional insurance products is available to mitigate whether such products are generally off-limits as it is involve in transactions or activities that sharia Islamic law prohibits.

Motor takaful is a car insurance plan that complies with the Shariah Islamic law and principles. Takaful is a type of Islamic insurance where members contribute money into a pool system in order to guarantee each other against loss or damage. In conventional insurance surpluses and profits belong to the shareholders of the insurance companies.

In present-day business one of the approaches to diminish the danger of misfortune because of incidents is through insurance. To understand the difference between takaful and insurance read along the article to. The Takaful industry in Malaysia is also regulated through the Islamic Financial Services 2013 act.

Ad Find your cheapest car insurance rates. Takaful does not permit uncertainity or gambling when it comes to risk assessment and handling and. While both takaful and conventional insurance provide similar resultsprotection from lossesthe methods behind each are different.

Our Reviews Trusted by 45000000. We have helped over 5 Million Auto-Owners Compare Top Insurance Plans. Takaful vs Conventional Insurance.

The details of your policy is based on a commercial sales agreement. Even if both takaful and conventional insurance do the same job providing coverage there are several significant differences between them. Ad Read and Compare Our Reviews of 2022s Top Auto Insurance Companies.

An insured person does not have a say in how the company invests the money. A quick comparison offers some more hints as to why Takaful is becoming more and more popular. In conventional insurance the risk is reduced for individuals through a contract.

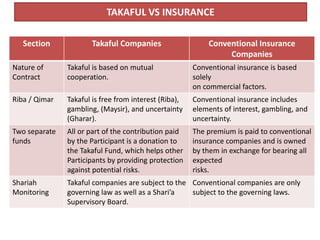

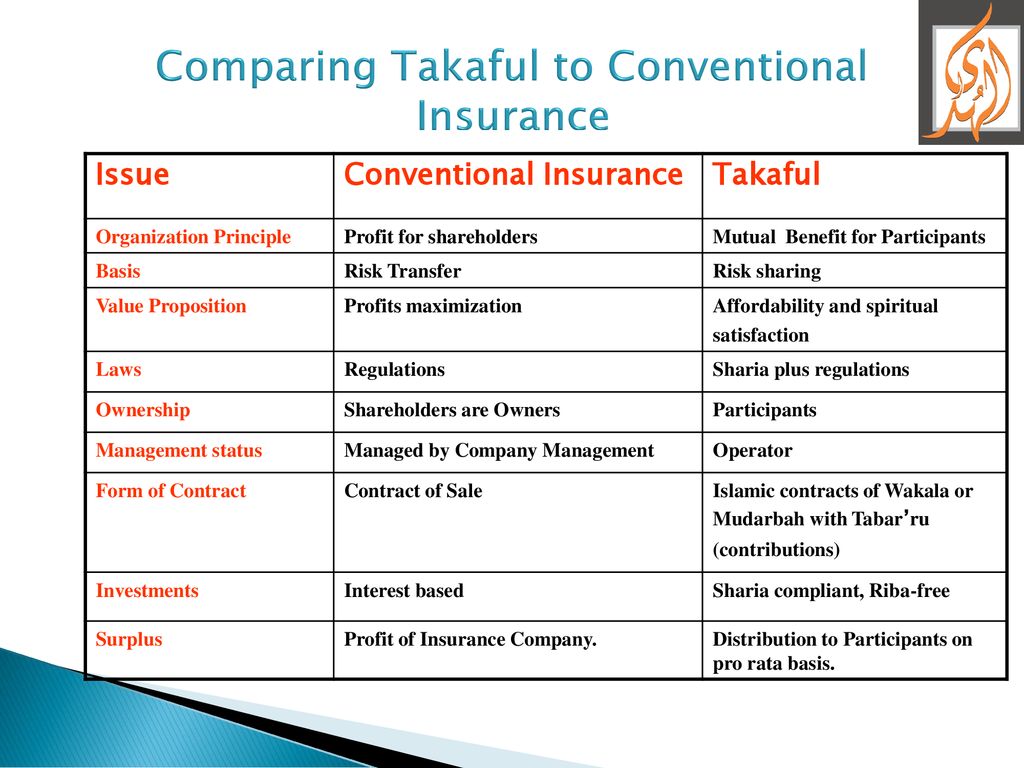

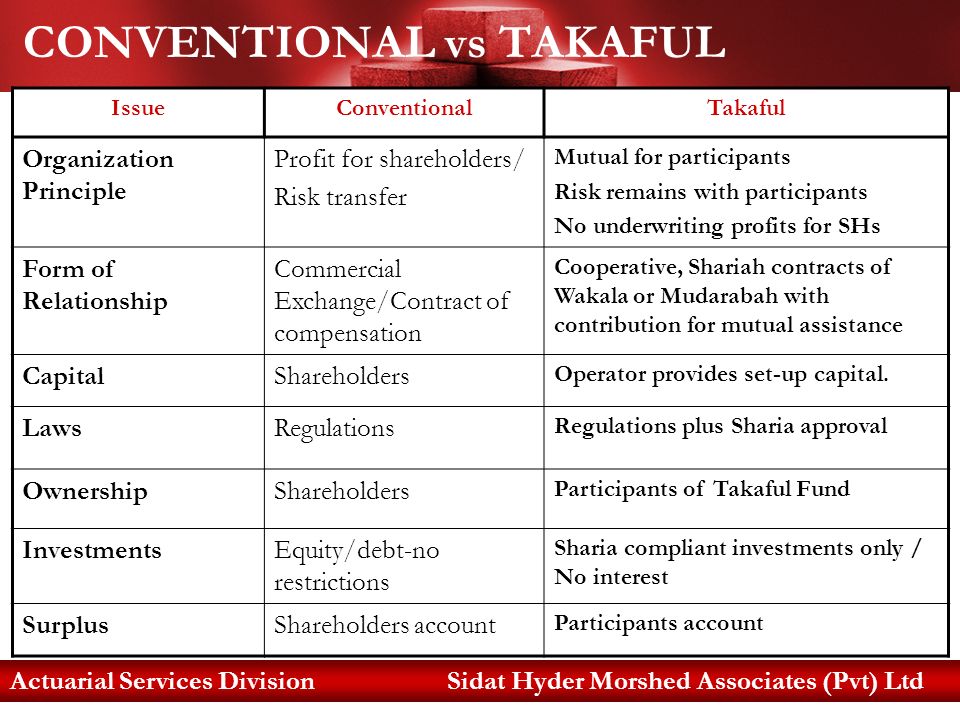

Save 500year when you compare. Conventional insurance Takaful and conventional insurance companies share the same objective of providing protection to you your loved ones and your valuable possessions. The main difference between conventional insurance and Takaful is that the former is a risk-transfer model whereas the latter is a risk-sharing model.

Each participant donates to a Takaful fund and in the event of loss the participant will receive the amount of its claim. Individual enters the agreement to contribute to a fund that can potentially help those. The term Takaful also refers to the concept of Islamic insurance based on mutual cooperation where both risks and funds are shared between the insured and insurer.

Takaful vs Conventional Insurance. Takaful-branded insurance is based on Sharia. Takaful is an alternative to the existing conventional insurance for.

Muslims are advised to purchase Takaful. Takaful in Malaysia Today In Malaysia in comparison to many other countries Takaful companies are heavily regulated through Shariah requirements under the Islamic Financial Services Act 2013 separately from conventional insurers. Takaful vs Conventional Insurance.

TAKAFUL being an Islamic alternative to conventional insurance is well known now. Takaful vs Conventional Insurance Common misconceptions about Takaful. Remember that since Takaful claims are paid from the community pool your monthly contributions may be lower and your benefits payout may be higher compared with conventional insurance.

Policyholders in takaful pool money together in the form of donations which is directed to a special fund. In short conventional insurance is a policy thats sold to you by a company. A wise person once said that the only certain things in life are death and taxes.

For us at EZTakaful its a no-brainer well choose the. The main advantage of Takaful over conventional insurance is that it is free from religiously forbidden elements and promotes a spirit of caring and sharing in. In Arabic Takaful means solidarity and cooperation among group of people.

TAKAFUL ISLAMIC INSURANCE vs CONVENTIONAL INSURANCE 1. Non-Muslims are welcome to purchase Takaful. The main different between conventional insurance and Takaful is the way in which the risk is handled and assessed along with the management of the Takaful fund.

The difference between Takaful and Conventional life insurance. A person joins the takaful agreement to contribute to the fund that can be helpful to the person or the group of. Having progressed from late 1970s following the rise of Islamic banking and finance it has established quite well.

The idea of insurance where assets are pooled to help the poor doesnt really repudiate Islamic standards. Ad Find the Right Auto Insurance Coverage for Your Needs from State Farm. The following table summarizes the main differences between both systems.

Conventional insurance-When you take a cover the company can invest that money provided that it will have something to pay you when the risk occurs. On the other hand takaful is a co-operative contract between takaful participants. Takaful is only for Muslims.

Takaful insurance is a form of co-operative insurance in compliance with Islamic Shariah which is based on the concept of shared contributions and mutual co-operation between the participants to compensate one another in case of loss. There are a few differences and similarities between conventional insurance and Takaful. The company can invest in bills and bonds or fixed deposits that earn interest.

Three significant contrasts differ in conventional insurance from Takaful. Takaful vs conventional insurance in arabic takaful means solidarity and cooperation among group of people. These contracts must be free of Riba Maisir and Gharar.

Takaful on the other hand is based on shared risk. Although essentially both Takaful and conventional life insurance serves the same purpose of providing coverage there are major differences between the two as can be seen below. Compared to conventional car insurance motor takaful plans are free from prohibited Islamic principles which are Riba interest Maysir gambling and Gharar uncertainty.

Compare 2022s Top 10 Auto Insurance Providers. We are going to see them one by one below. Takaful vs Conventional Insurance.

Although both conventional and takaful businesses generate profits for the shareholders in takaful business the expenses paid to the shareholders are explicitly transparent in conventional insurance they are not necessarily so. EXPLORING THE FUNDAMENTAL OF ISLAMIC INSURANCE 2.

Takaful Islamic Insurance Vs Conventional Insurance Youtube

Takaful Vs Conventional Insurance Do They Even Compare Eztakaful

Conventional Insurance Vs Takaful What Are They

Conventional Car Insurance Vs Motor Takaful Bjak Malaysia

Takaful Insurance Gulf Insurance Brokers Llc

Introduction To Takaful For Beginners

Takaful And Conventional Insurance Copy 01 The Money Doctor

Takaful Islamic Insurance Vs Conventional Insurance

Conventional Car Insurance Vs Motor Takaful Bjak Malaysia

Pdf Demographic Analysis Towards The Understanding Of Education Takaful Islamic Insurance Plan Semantic Scholar

Differences Between Conventional Insurance And Takaful Download Scientific Diagram

Takaful Islamic Insurance Ppt Download

Difference Between Takaful And Conventional Insurance Pdf Takaful Versus Conventional Insurance Comparing The 2 Types Of Literature Based On Mutual Course Hero

Pdf An Analysis Of Islamic Takaful Insurance A Cooperative Insurance Mechanism Semantic Scholar

What Difference Between Takaful Vs Conventional Insurance Mi Adviser

Differences Between Conventional Insurance And Takaful Download Scientific Diagram

A Complete Guide Takaful Vs Conventional Insurance In Malaysia

Conventional Insurance Takaful Concept Takaful Rules Retakaful Ppt Video Online Download

How Does Takaful Compare To Conventional Insurance

.bmp)